Transforming Tax Landscape for National Growth

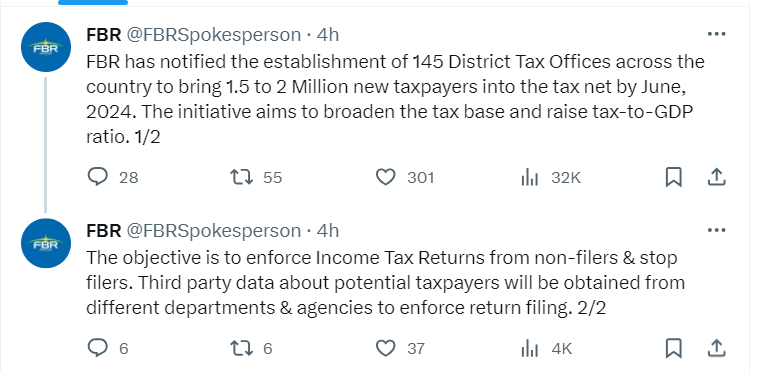

In a decisive move towards transforming the tax landscape of the nation, the Federal Board of Revenue (FBR) has embarked on an ambitious mission. With the establishment of 145 District Tax Offices across the country, the FBR has set its sights on a lofty target: integrating 1.5 to 2 million new taxpayers into the realm of tax compliance by June 2024.

This bold endeavor is meticulously designed to not only broaden the tax base but also to elevate the tax-to-GDP ratio, thereby fortifying the country’s fiscal position.

At the heart of this monumental initiative lies the stringent enforcement of Income Tax Returns. The FBR’s focus extends keenly towards non-filers, all while ensuring that existing filers dutifully fulfill their obligations.

Employing a sophisticated strategy, the FBR intends to leverage third-party data procured from a diverse array of departments and agencies. This strategic maneuver aims to pinpoint and encourage potential taxpayers to adhere to their return filing responsibilities.

Through a multifaceted approach, the FBR seeks to profoundly enhance tax compliance on a nationwide scale.

Strengthening the Tax Infrastructure

The establishment of 145 District Tax Offices represents a pivotal step towards fortifying the tax infrastructure across the nation. These offices serve as local hubs, facilitating accessible avenues for taxpayers to engage with the system, seek guidance, and fulfill their obligations.

Moreover, their strategic placement ensures widespread coverage, reaching even the remotest regions, thereby promoting inclusivity in tax compliance.

Harnessing Third-Party Data for Enhanced Compliance

One of the cornerstones of the FBR’s strategy involves the judicious utilization of third-party data. By tapping into information sourced from various governmental departments and agencies, the FBR aims to identify potential taxpayers who have thus far eluded the radar of compliance.

This comprehensive data-driven approach not only streamlines the identification process but also significantly reduces the room for evasion or non-compliance.

The Impact on Tax Compliance Nationwide

Through the confluence of these initiatives, the FBR anticipates a paradigm shift in tax compliance dynamics throughout the country. The infusion of new taxpayers into the system is expected to substantially augment the tax base.

Consequently, this broadened tax base will play a pivotal role in bolstering the tax-to-GDP ratio, a critical metric indicative of the country’s fiscal robustness.

Performance Metrics and Projected Outcomes

The FBR has set stringent performance metrics to gauge the efficacy of its initiatives. These metrics encompass not only the number of new taxpayers brought into compliance but also the subsequent impact on the tax-to-GDP ratio. Projections indicate a marked improvement in this ratio, showcasing the success of the concerted efforts aimed at enhancing tax compliance.

Table: Projected Outcomes

| Metrics | Projections |

|---|---|

| New Taxpayers Integrated | 1.5 to 2 million |

| Expected Tax-to-GDP Ratio | Increase by X% |

| District Tax Offices | 145 |

| Third-Party Data Sources | Multiple Departments |

Conclusion

The FBR’s proactive measures, centered on the establishment of District Tax Offices and leveraging third-party data, signify a watershed moment in the realm of tax compliance. By cultivating a more expansive tax base, the FBR not only aims to meet immediate revenue goals but also lays the groundwork for sustained fiscal stability. As the nation moves forward, these strategic initiatives pave the way for a more robust and equitable tax ecosystem, driving progress and economic resilience.